The opportunity for Netflix employees to purchase stock options is exciting, but also pretty confusing. How do you determine whether to participate?

**An earlier version of this analysis incorrectly compared the value of stock to the net gain on options. This inadvertent double counting of the cost of the options required a greater return or longer time frame to break even than is accurate. I want to thank a couple readers, including Noah B., for pointing out my error and allowing me to fix my mistake. I apologize for any confusion this may have caused.

When I first looked at the Supplemental Allocation of the Netflix Stock Option Plan (SOP), I must admit I was intrigued from a professional curiosity standpoint. I haven’t seen any other company plan quite like this. I’ve seen companies grant awards of stock options and I’ve seen employees able to purchase company stock, but I have not seen a plan that allowed employees to buy the higher-risk/higher-reward stock options. Being the nerd that I am, I ran to Excel to try to conceptualize how risky these options are. After talking it out with Trishul Patel and Meg Bartelt, I’ve identified the factors you need to understand before deciding to participate in the Netflix Stock Option Plan Supplemental Allocation.

*This analysis is focused on the Supplemental Allocation; the choice to forego a portion of your salary in exchange for purchasing stock options.

I can purchase options?

Most publicly traded companies use company stock as a way to reward and incentivize employees; to align their personal interests with company leadership. Of these companies, the trend is to grant employees Restricted Stock Units (RSUs), rather than stock options. And when given the chance to purchase more company stock with their own money, it is usually in the form of an Employee Stock Purchase Plan (ESPP). The ability to purchase higher upside options is an unusual benefit for Netflix employees.

But I have to pay for these options…

Yes. Unlike stock option or RSU awards, you decide how much of your salary you would like to devote to buying the grant of stock options. Each month the money you have set aside from your pay check will purchase options at 40% of the current stock price. This allows you to buy 2.5 times more options than shares.

If you save $1,000 from your pay check and the current NFLX stock price is $500, instead of purchasing 2 shares of stock, you can purchase 5 options at $200 each.

These options last ten years and allow you to buy NFLX stock at an exercise price of $500, even if the stock appreciates above that.

You get to keep these options for ten years, even if you no longer work at Netflix. Many companies force you to exercise or lose your options if your employment is terminated.

How does leverage work?

When you first purchase the options, you have the right to buy NFLX at $500, but the current market price is $500 if you wanted to sell, so your “intrinsic value” is $0. You need the stock price to go up for the options to have any value. You also need to consider the money you spent purchasing the options.

As the stock price goes up, the value of your options goes up 2.5 times faster than if you had bought shares of stock, just starting from a lower value.

At a stock price of $600, your 5 options have an intrinsic value of $100 each ($600 current price - $500 purchase price = $100 intrinsic value), for a total value of $500. BUT you need to remember that you spent $1,000 on these options. Your investment is still $500 in the hole.

You need the stock price to go up 40% just to break-even.

When does my investment pay off?

Whenever I am helping a client analyze an investment decision, I point out that we can’t just look at whether it is profitable or not. We need to consider the “opportunity cost” of what else we could have done with the money. If the alternative was the leave the money in cash earning nothing, then our break-even number is all we need to reach. In our example, purchasing options when the stock is at $500 require the stock to increase to $700 to make up for the money we spent on the options.

But if the alternative is buying shares of Netflix stock instead of options, the increase in the stock price, necessary for the options to have value, also increases the alternative to which we are comparing.

You need Netflix stock to increase 67% for your investment in options to be worth more than an alternative investment directly in Netflix shares.

This chart illustrates our example above. If you start with $1000 and the stock price is currently $500, you can purchase 2 shares of stock or 5 options with an exercise price of $500.

The option value doesn’t make up for the cost of purchasing the options until the stock price gets to $700. This is the 40% gain over $500 needed to break-even.

The option value doesn’t catch up up to the alternative of buying stock until the stock price is at $833.33 or 67% above the $500 purchase/exercise price.

Another way to compare the options to the underlying stock is to look at the rate of return on your investment.

If the stock drops at all from it’s starting point, the options have lost 100% of their value.

You NEED the stock price to go up for the options to have any value. Yes this is important enough that I am reiterating it here. Stocks can go down in the future, but if you bought the stock, you still have some value. If you bought the options, you have lost all of your investment.

When the stock price goes up 40%, your options have just gotten back to a 0% rate of return on your investments. Some nice appreciation on the stock and you’re right back where you started.

With a growth of 67% (technically two-thirds, 66.6666…%) your options have just caught up to where you could have been if you bought the stock. But you still need the stock price to increase even further before you start to realize the benefit of purchasing options. If the stock price gets up 60%, then drops from there, you still would have been better off buying the stock outright instead of options.

For those who would like to double-check my math comparing one share of stock to 2.5 options:.

Options Value = 2.5 x (NFLX Stock Price - Exercise Price)

When the current NFLX Stock price = Exercise Price, the Options Value is $0

For the Options Value to equal your starting point, the NFLX Stock Price needs to be 40% greater than the Exercise Price.

For the Options Value to equal the current NFLX Stock Price (remember the Exercise Price = Cost of 2.5 Options), the NFLX Stock Price needs to be 67% greater than the exercise price.

But this is with pre-tax dollars. That helps, right?

Sort of, but not really. These are Non-Statutory Stock Options (NSOs), so when you exercise, the difference between the Fair Market Value (FMV) at the time of exercise and the exercise price (a.k.a. the spread or bargain element) is taxed as ordinary income. If your tax rate is the same when you purchase the options and later exercise (and probably sell), any tax benefit you received upon purchasing the options results in a additional taxable income when you exercise the options.

If you were able to control your the timing of your tax rate, it is possible to benefit if you can purchase the options while you are at a higher tax rate, then exercise the options when you are at a lower tax rate.

If your tax rate is likely to stay the same over the next several years, there is no real benefit to buying options with pre-tax dollars.

More about taxes…

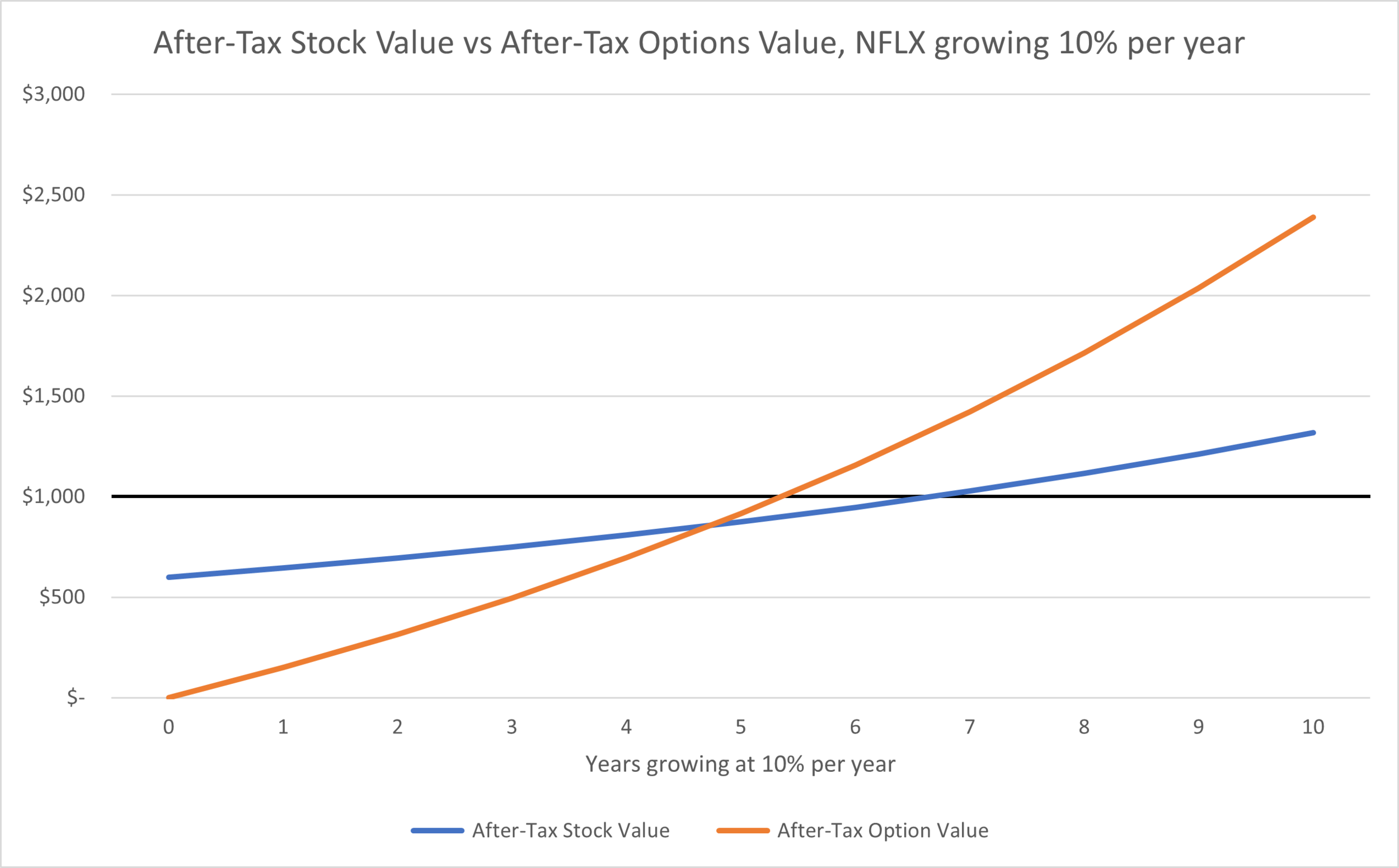

The comparison above is not truly apples-to-apples because it assumes we are buying shares of stock with pre-tax dollars. We should be comparing the after-tax value of options to the after-tax value of buying shares.

The cost of the options is pre-tax, but in the likely scenario you sell the stock as soon as we exercise (cashless exercise), you will owe ordinary income taxes on the spread. We will assume a combined federal and state ordinary income tax rate of 40%.

With the same ordinary income rate, instead of having $1000 to buy shares or stock, you would only have $600. Then as the stock grew, when you sell you would owe capital gains taxes on the growth. We will assume a combined federal and state capital gains tax rate of 25%.

A better comparison

Assuming NFLX grows by 10% per year…

It would take almost 5 years for the value of the options to catch up to the value of the stock we could have purchased instead. NFLX would need to grow by 57% from $500 to $785.72 for the options to be worth it.

But Netflix has been growing faster than 10% per year!

True. Netflix Inc has returned over 40% per year for the last decade. Anyone who already owned options more than a couple years old has greatly benefited. Moving forward, it is not safe to assume that NFLX will continue to outperform the broader US stock market by 28% per year.

For reference, US Large Cap stocks have averaged approximately 13% over the last ten years and have a long term historical average closer to 10%.

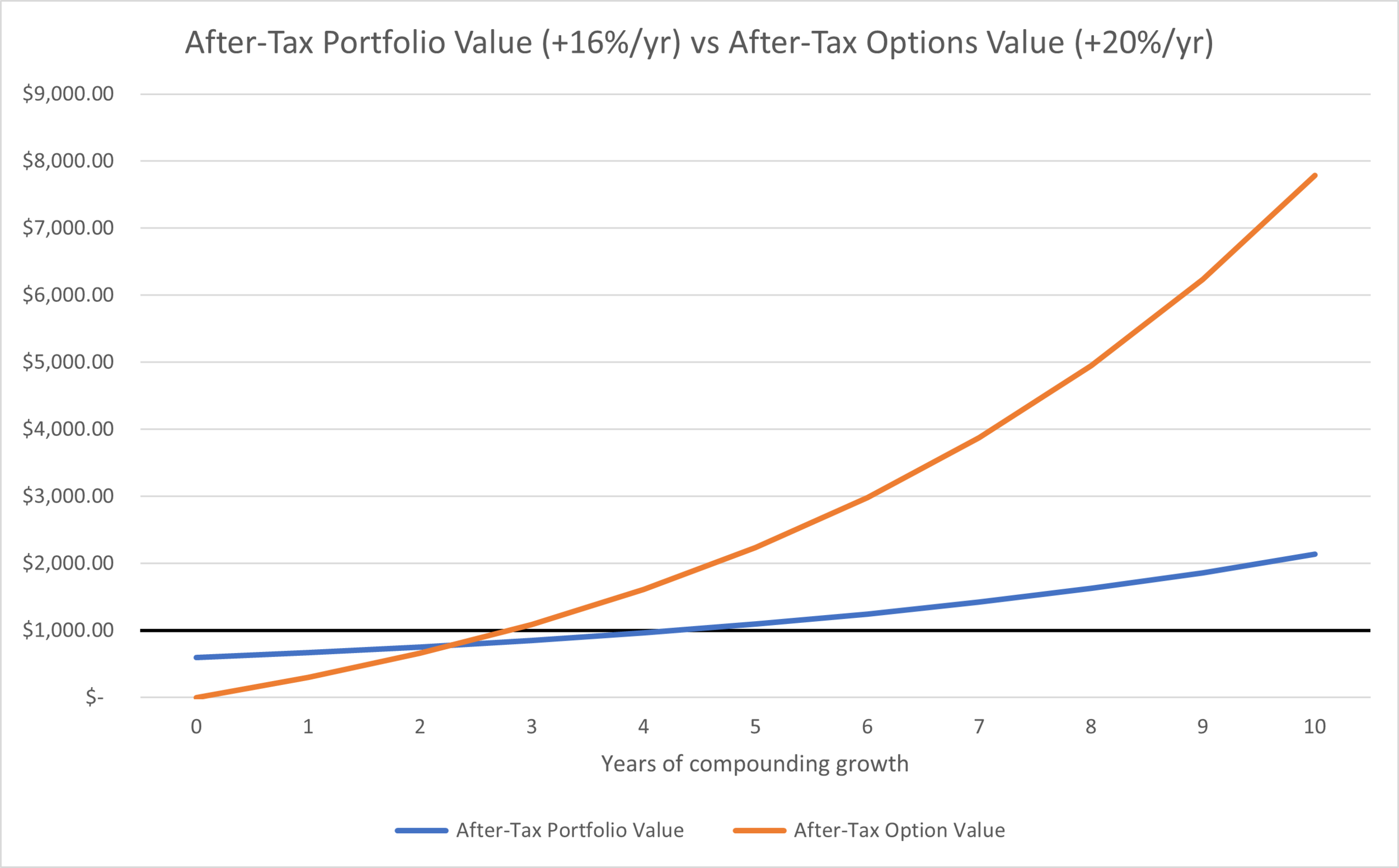

The most realistic comparison

So far we have compared buying options to buying shares in the same underlying stock. This allows us to assume the growth of the stock is identical in each case. Realistically, if someone is not participating in the Netflix Stock Option Supplemental Allocation, they are probably not going to transfer the money to a brokerage account and buy shares of Netflix stock. They may save it in cash for a down payment on a house, invest in a diversified portfolio, or just spend it.

If they are working with an advisor or have the discipline to invest before spending the extra cash, then it makes sense to compare Netflix returns vs. the broader market.

It turns out that the delta between Netflix and the alternative investment is less important than the nominal return of Netflix stock. As long as Netflix is on pace to make up for the cost of the options (VERY roughly exceeding 5% per year), then the benefits of the leverage can help make the options worth the cost.

Here are three realistic comparisons:

NFLX outperforms the market by 4% (+20% vs +16%) per year. The options pay off in a little over two years.

NFLX outperforms the market (+5% vs +3%), but it takes over eight years for the options to catch up. If Netflix averages less than 4% per year over the decade before the options expire, it is unlikely they make up for the opportunity cost.

NFLX actually underperforms the market by 4% (+10% vs +14%), but the returns are still high enough for the leverage to pay off.

After trying a few different tax rates and comparisons to a variety of market returns, it becomes clear the nominal return of Netflix stock itself has the biggest impact on the success of the option strategy.

If I had to try to oversimplify it down to single decision…

Over the next decade, do you think NFLX will be in line with the long-term average of large cap stocks?

Are the options a bad deal?

No, they are probably fairly priced. We can use a Black-Scholes Calculator to determine how much these options would cost if they were available on the open market.

Based on the following inputs:

$500 Current Stock Price

$500 Exercise Price

10 years to Maturity/Expiration

The value of the options on the open market would be $296.05 and you are only paying $200. If Netflix maintains similar volatility as it has in the past, there is value in getting the options at a discount. However, if the volatility drops to 30%, the cost of a comparable option would drop to $198.38 and you are no longer getting these options at a discount.

Risk Tolerance

What is the goal for this money? What is your time frame? How would you feel if NFLX stayed flat or went down and you lost all the money you put in these options?

CONCLUSION

The Supplemental Allocation within the Netflix Stock Option Plan is fair. It is higher-risk, higher reward, but if you are willing to lose your entire investment, it is realistic that the options will eventually pay off. Remember, thinking of it as a higher upside version of an ESPP understates the risks dramatically. This is not the same as being awarded stock options at a small company that would allow you to participate in the growth of the company without putting your own money at risk. This is possibly the riskiest employee benefit I have seen.

There is no liquidity for these options once you purchase them, so you need to wait 2-8 years just to get your money back. You are also limited to 10 years for the options to catch up to an alternative. This is a relatively small window for an investment so risky.

I would likely recommend a client max out their 401k first. Then, save for other goals, such as a property or child’s college education in another vehicle.

After taking care of other life priorities, this is can be an acceptable investment for excess income or savings.

If you would like a copy of the Excel spreadsheet I created to run this analysis, please feel free to email me at aaron.agte@graystoneadvisor.com.

If you have questions about if or how you should incorporate Netflix stock options into your personal financial situation you can take a look at my calendar to schedule a meeting at a time that works for you.

Aaron Agte, CFP®, founder of Graystone Advisor, is a fee-only Financial Planner located in Foster City, CA, serving clients virtually in the Bay Area and across the country. He specializes in helping couples with stock options, RSUs, and other equity compensation.

@AaronAgteCFP